Plastics tax – what you need to know

The UK government wants to increase the amount that is recycled and so on 1 April 2022 a plastics tax on plastic packaging containing less than 30% recycled plastic was introduced. The tax covers packaging which is manufactured in the UK or imported into the UK. The rationale behind the tax is that it will […]

Preparing your 2021/22 Personal Tax Return

Child Benefit: If you or your partner claim child benefit you may be required to report this income on your Return. In particular, if you or your partner earn over £50,000 the High Income Child Benefit Tax Charge will apply. This charge will be due from the individual with the highest income who may not […]

Electric cars – saving tax and the environment

Capital Allowances Where an electric car is purchased either outright or via a Hire Purchase agreement, the capital allowances available to the company are much higher than those usually attributable to cars. Brand new pure electric cars will usually qualify for First Year allowances (FYA). FYAs give 100% tax relief in the year of purchase […]

Making Tax Digital for Income Tax Self-Assessment (MTDITSA) Change is coming

The focus of MTDITSA is currently on self-employed businesses and property owners with annual income above £10,000. Note that this is ‘income’, not net profits. Furthermore, we understand this £10,000 is total income meaning that if you receive gross rental income of £6,000 and gross self-employment income of £6,000 you will have breached the £10,000 […]

R&D Claims – Changes are afoot and preparation is key

HMRC’s response has been twofold. Firstly, HMRC recently announced a pause in some Research & Development Tax Credit payments whilst they investigate irregular claims. This has led to significant delays in the payment of tax credits to clients, with HMRC failing to meet their target of 4-6 weeks. Secondly, a number of key changes will […]

HMRC is changing the way trading income is allocated to tax years

However, the government is looking to align all basis periods for unincorporated businesses with the tax year (6 April to 5 April). This is to facilitate Making Tax Digital for Income Tax Self-Assessment which is due to begin on 6 April 2024. The reform of the basis period rules does not mean the accounting date […]

Businesses urged to be prepared for furlough inspections

The Coronavirus Job Retention Scheme, commonly referred to as furlough, protected nearly 12 million jobs across the UK during the pandemic with the government subsidising up to 80% of employees’ wages. While the scheme prevented mass unemployment and supported businesses through an unpredictable financial period, it is reported that furlough has cost the government £70 […]

Payroll End of Year 2021/22

Final Submission for the Current Tax Year The final payroll must be processed on or before 5 April 2022, in line with the usual pay date. The final submission via Real Time Information is required by 19 April 2022. Documents for Employees P60 forms must be prepared and issued to employees by 31 May 2022. […]

Changes to Payroll Legislation for the 2022/23 Tax Year

The main changes for 2022/23 are increases in National Minimum and Living Wage rates and the introduction of the National Insurance increase to cover Health and Social Care. Changes to National Minimum & Living Wage Rates The rates are set to rise again this year, with the increase of 6.6% for the National Living Wage […]

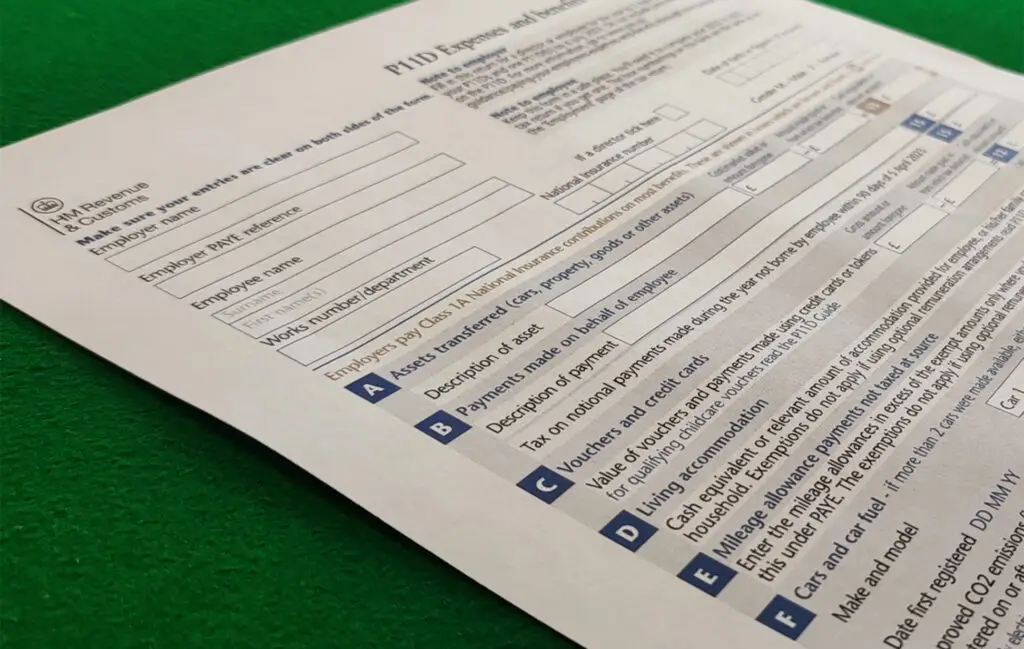

P11D time of year

Many employers offer their staff a reward package that includes benefits-in-kind, such as company cars, private medical insurance and other items such as gift vouchers. The P11D will detail any taxable benefits and expenses received by an employee over the tax year. The benefit calculations are not always straightforward and specialist advice may be needed. […]