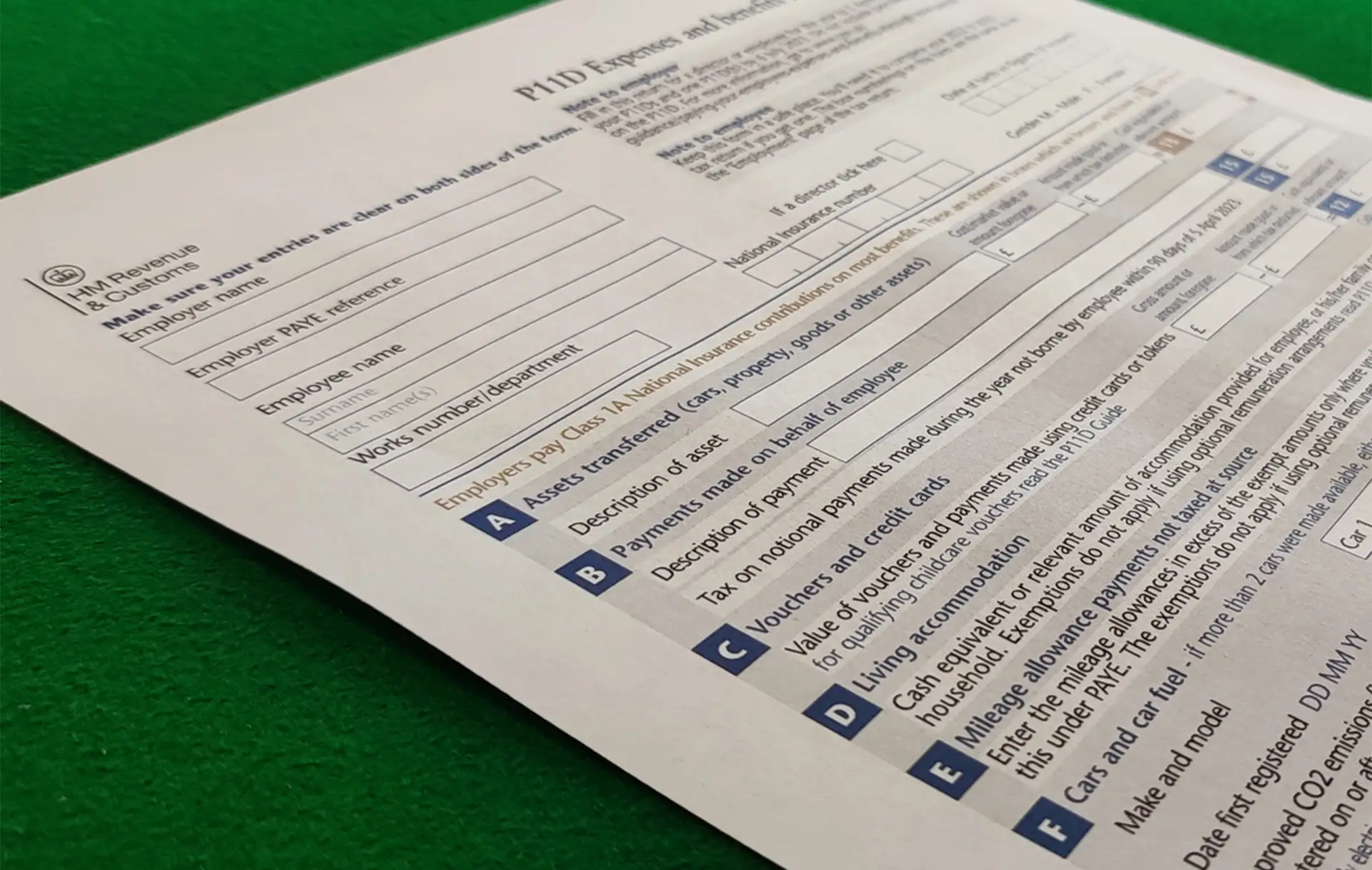

Many employers offer their staff a reward package that includes benefits-in-kind, such as company cars, private medical insurance and other items such as gift vouchers. The P11D will detail any taxable benefits and expenses received by an employee over the tax year. The benefit calculations are not always straightforward and specialist advice may be needed.

Employers must submit the P11D forms to HMRC, together with a summary form P11D(b) which details the amount of Class 1A National Insurance payable. The 2021/22 P11Ds are due for submission by 6 July 2022 and late submission will result in monthly fines of £100.

Employers will be liable to pay Class 1A National Insurance at 13.8% of the total value of benefits provided in 2021/22. The payment deadline is 19 July 2022 or 22 July 2022 if paying electronically.

Employees pay income tax on the benefits received, usually through an adjustment to their PAYE code or sometimes via their tax return if they are registered for Self-Assessment.

Some common benefits that an employer must include on the P11D are listed below:

- Interest free loans

- Living accommodation

- Company cars or vans

- Childcare vouchers

- Private health insurance

- Assets transferred to an employee

Some expenses and benefits can be taxed through payroll instead, but this is not possible for all benefits. For example, company cars and living accommodation benefits cannot be payrolled.

Other irregular benefits, most commonly staff entertaining, which would not be practical to include on a P11D for each member of staff can be included in a PAYE Settlement Agreement where the employer pays the employee’s tax on their behalf.

At Kilsby Williams our dedicated team of tax specialists offer a comprehensive range of tax services covering all aspects of corporate, business and personal tax compliance and planning. Our approach to tax advice is to provide tailored solutions to minimise your tax burden. Please contact Kilsby Williams if you would like any advice on employee benefits and expenses or assistance with the submission of P11Ds and/or PAYE Settlement Agreements.