The main changes for 2022/23 are increases in National Minimum and Living Wage rates and the introduction of the National Insurance increase to cover Health and Social Care.

Changes to National Minimum & Living Wage Rates

The rates are set to rise again this year, with the increase of 6.6% for the National Living Wage being the largest annual increase on record.

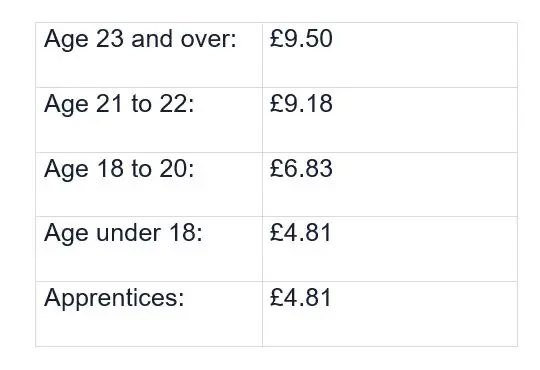

The new rates which should be applied from the first pay reference period after 1 April 2022 are as follows:

The apprentice rate only applies to apprentices who are either aged under 19 or aged 19 or over and in the first year of their apprenticeship. After the first year of the apprenticeship, those aged 19 or over must be paid the higher rate based on their age.

Health and Social Care Levy

A temporary increase of 1.25% will be applied to all National Insurance contributions for the 2022/23 tax year. For payrolled employees, this will mean standard Employee National Insurance contributions will increase from 12% to 13.25% on earnings between the Primary Threshold (£9,880 per year) and Upper Earnings Limit (£50,270 per year) and will increase from 2% to 3.25% on any earnings above this. Employer contributions will increase from 13.8% to 15.05% on any earnings above the Secondary Threshold (£9,100 per year).

The increase in National Insurance contributions for 2022/23 will be replaced in the following 2023/24 tax year by a separate levy, whereby National Insurance rates are expected to return to their current levels and the additional 1.25% will be deducted as a separate item, alongside tax, National Insurance and any pension contributions made.

For the 2022/23 tax year, any employees over State Pension Age will not be required to contribute, but their pay will be subject to the levy from April 2023.

Kilsby Williams provide a full secure payroll bureau service by qualified professionals. If you would like further guidance on the changes for the new tax year or to discuss the possibility of outsourcing your payroll to alleviate the administrative burden of implementing the changes, please contact our Payroll Team at 01633 810 081 or payroll@kilsbywilliams.com.