Payroll End of Year 2021/22

Final Submission for the Current Tax Year The final payroll must be processed on or before 5 April 2022, in line with the usual pay date. The final submission via Real Time Information is required by 19 April 2022. Documents for Employees P60 forms must be prepared and issued to employees by 31 May 2022. […]

Changes to Payroll Legislation for the 2022/23 Tax Year

The main changes for 2022/23 are increases in National Minimum and Living Wage rates and the introduction of the National Insurance increase to cover Health and Social Care. Changes to National Minimum & Living Wage Rates The rates are set to rise again this year, with the increase of 6.6% for the National Living Wage […]

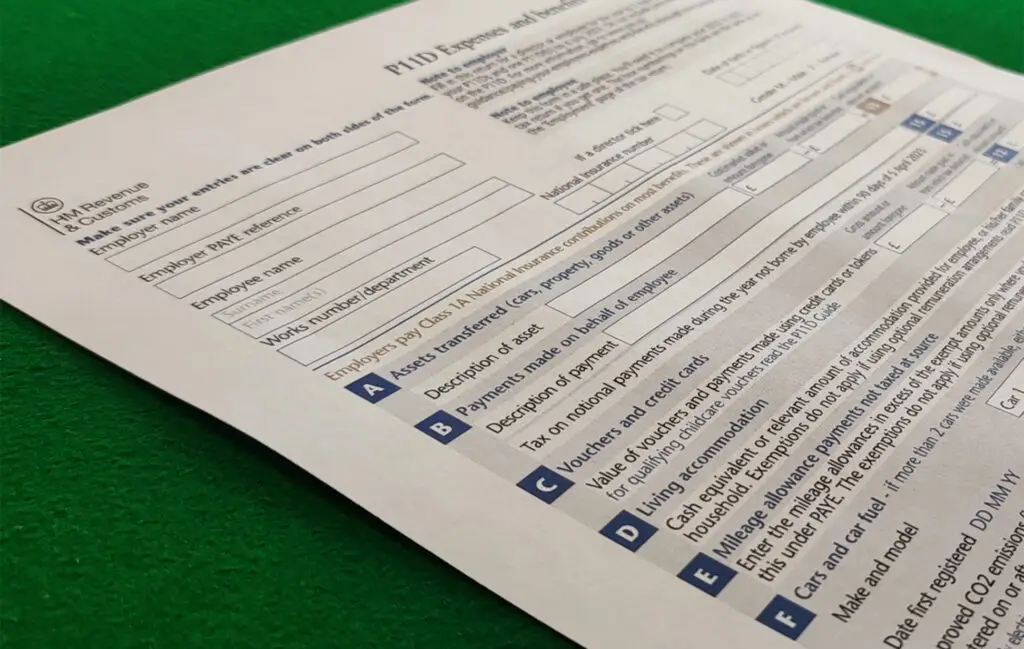

P11D time of year

Many employers offer their staff a reward package that includes benefits-in-kind, such as company cars, private medical insurance and other items such as gift vouchers. The P11D will detail any taxable benefits and expenses received by an employee over the tax year. The benefit calculations are not always straightforward and specialist advice may be needed. […]

Mitigating the impact of the increase in National Insurance Contributions (NIC)

Currently employees pay 12% NIC on earnings between £9,568 and £50,270 (£9,880 from April 2022) and 2% on income over that level. Employers suffer 13.8% on income over £9,100. This will rise to 13.25% and 15.05% from next month respectively. What can be done to mitigate exposure for employees and employers to this increase? Dividend […]