Changes to Payroll Legislation for the 2022/23 Tax Year

The main changes for 2022/23 are increases in National Minimum and Living Wage rates and the introduction of the National Insurance increase to cover Health and Social Care. Changes to National Minimum & Living Wage Rates The rates are set to rise again this year, with the increase of 6.6% for the National Living Wage […]

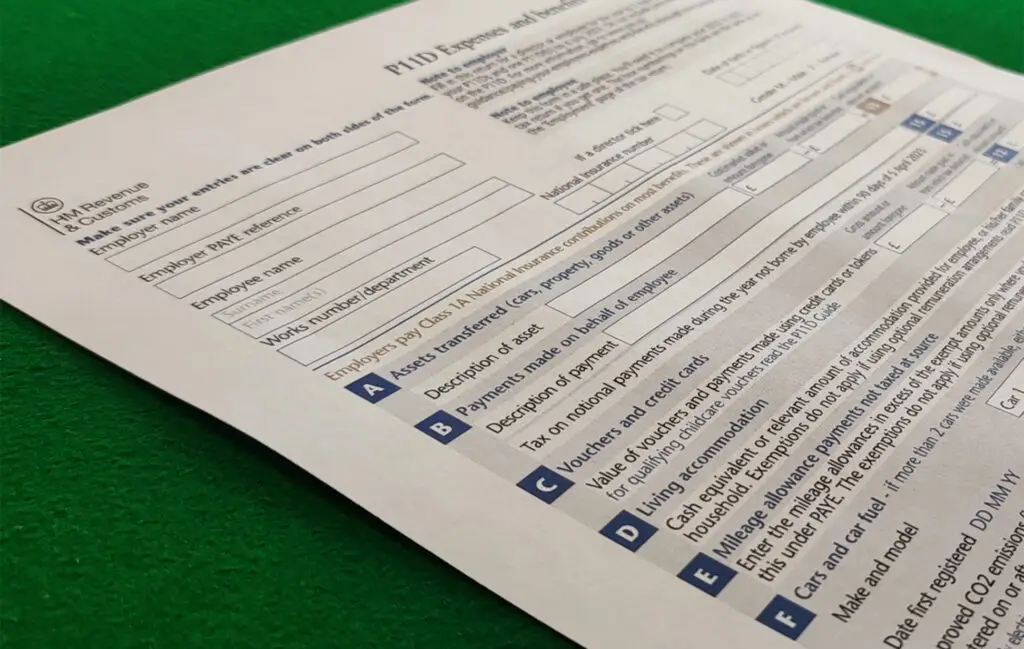

P11D time of year

Many employers offer their staff a reward package that includes benefits-in-kind, such as company cars, private medical insurance and other items such as gift vouchers. The P11D will detail any taxable benefits and expenses received by an employee over the tax year. The benefit calculations are not always straightforward and specialist advice may be needed. […]

Mitigating the impact of the increase in National Insurance Contributions (NIC)

Currently employees pay 12% NIC on earnings between £9,568 and £50,270 (£9,880 from April 2022) and 2% on income over that level. Employers suffer 13.8% on income over £9,100. This will rise to 13.25% and 15.05% from next month respectively. What can be done to mitigate exposure for employees and employers to this increase? Dividend […]

ERF application deadline approaches

The ERF is a Welsh Government fund of £120 million that businesses in Wales can access if they were impacted by the alert level two measures put in place due to rise of the Omicron virus. Welsh Businesses in the retail, hospitality, leisure and tourism sectors, as well as their supply chains, are eligible to […]

Kilsby Williams joins the fight in cybercrime

The WCRC is part of a network of centres established across the country providing a highly accessible and respected cyber resource, in an unregulated market, for simple yet effective cyber security guidance and support to all businesses which need it. Simon has been appointed to the WCRC’s board which plays a key role in providing […]

New Partner steps up at Kilsby Williams

Jonathan joined Kilsby Williams in 2007 and since then has established a wide portfolio of clients. As an associate in the business services department, Jonathan was responsible for carrying out audit, business valuations and financial due diligence on behalf of clients. In his new role Jonathan will continue to oversee client accounts as well as […]

Don’t miss tax deadlines

If the return is filed more than three months late, an additional £10 per day is charged and, after six months, another penalty is incurred (the higher of £300 or 5% of the tax due). The flat-rate penalties will stand even if the tax return shows no tax. Your company’s corporation tax return is due a […]

Where there’s a Will…

They may also need to pay inheritance tax (IHT) if the net value of your assets, including your home and any insurance policies that pay out to your estate on death, exceeds the nil rate band (NRB) of £325,000. The IHT rate above this threshold is 40%, or 36% if at least 10% of your […]

Accelerate your tax relief

You can save or delay tax by advancing the acquisition of assets to before the end of your accounting period. This permits you to claim the capital allowances associated with those assets earlier. If you trade through a company, you can claim a super-deduction of 130% of the cost of new plant and machinery purchased before […]

Claim for your company’s losses

The trading losses from these periods can be carried back to set against total profits of accounting periods ending in the previous three years. There are two £2 million caps (one for each financial year in which the loss is generated) for the losses carried back to the two earliest years of the three. Claims […]