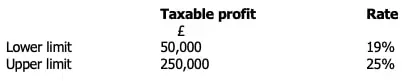

Where taxable profit falls between the lower and upper limits, a company pays tax at an effective rate of 26.5%.

The limits are reduced for periods of less than 12 months and are dependent on the number of associated companies.

Definition of Associated Company

A company (regardless of its tax residence) is associated with another company when it is active and under the same control. Control can be direct or indirect and future rights are also taken into account. Care should therefore be taken when, for example, there is a future agreement to pass on a family business or where share options have been granted.

The attribution of rights between connected persons must be taken into account when there is ‘substantial commercial interdependence’. Substantial commercial interdependence exists if companies are financially, economically or organisationally interdependent.

It is possible therefore that a company owned by (say) a father will be associated with a company owned by his (say) daughter if the father’s company introduces customers to the daughter’s company, the father uses premises owned by the daughter’s company, and/or the father’s company provides a loan to the daughter’s company.

The rules also include a ‘minimum controlling combination’ requirement to identify controlling parties.

Dormant companies and passive holding companies can be excluded.

Payments on Account of Corporation Tax

The associated companies’ rules affect the timing of payment of corporation tax, as the thresholds for being large (£1.5m), becoming large (£10m) and being very large (£20m) are divided by the number of associated companies. This may mean that companies not previously within the payment on account regime are affected after 1 April 2023 such that the payment of corporation tax is accelerated.

Action

What this all means is that something as simple as determining a company’s rate of corporation tax and when this tax needs to be paid needs a complex analysis of shareholder affairs and connections.

We therefore encourage all our current and potential future clients to consider the impact of these rules. If you would like assistance with associated companies determinations, marginal rate calculations, or forecasting for payments on account, please contact Rob Meredith on 01633 653198 or rob.meredith@kilsbywilliams.com, your usual Kilsby Williams adviser on 01633 810081 or email info@kilsbywilliams.com.