This is why we expect there to be a rise in the number of EV salary sacrifice schemes introduced by employers over the next few years, which make leasing EVs much more affordable for employees with no upfront costs.

How does it work?

An EV salary sacrifice scheme lets an employee pay for an electric car each month using their gross salary, before tax and National Insurance Contributions (NICs) are deducted. The company leases the car from a supplier and the employee leases it from the employer. The employee pays for the car using gross pay and income tax and NIC is charged on the remaining salary.

What are the savings and isn’t there a benefit-in-kind on a company car?

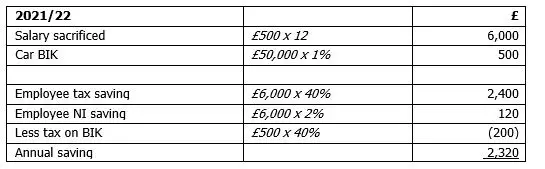

Company cars attract a benefit-in-kind (BIK) but unlike other benefits that are common through salary sacrifice schemes, company cars are not taxed based on the amount of salary sacrificed. Instead, tax is payable on the value of the BIK. For EVs the BIK is 1% of the car’s list price for 2021/22 and 2% for 2022/23 (remaining at 2% until at least 2024/25). The savings are best illustrated with an example:

Example

An employer operates an EV salary sacrifice scheme taken up by an employee that pays higher rate tax. The employee sacrifices £500 of salary per month (usually equal to the car lease cost) in return for an electric car with a list price of £50,000.

In this example, if the employee had leased the car privately the annual cost would have been £6,000. Compared with a decrease in net wages of £3,680 through the EV salary sacrifice scheme this is an annual saving of £2,320 for the employee.

Are there any benefits for the employer?

The benefits to the employer of operating an EV salary sacrifice scheme are:

- Employer NIC savings (£759 in the example above) which could be passed on to the employee

- An attractive employee benefit that increases employee retention and engagement

- Lower cost per business mile than petrol/diesel cars

- No upfront additional cost to the employer

- Fully maintained and insured company cars managed by the leasing company

As there are clear tax benefits to both employees and employers, now would be an ideal time for employers to consider adding an EV salary sacrifice scheme to their remuneration packages to attract the best staff. Employers should however take into consideration all costs of leasing an EV in conjunction with the tax benefits.

If you have any queries or would like to discuss this further, please do not hesitate to contact your Kilsby Williams team member on 01633 810081 or info@kilsbywilliams.com.