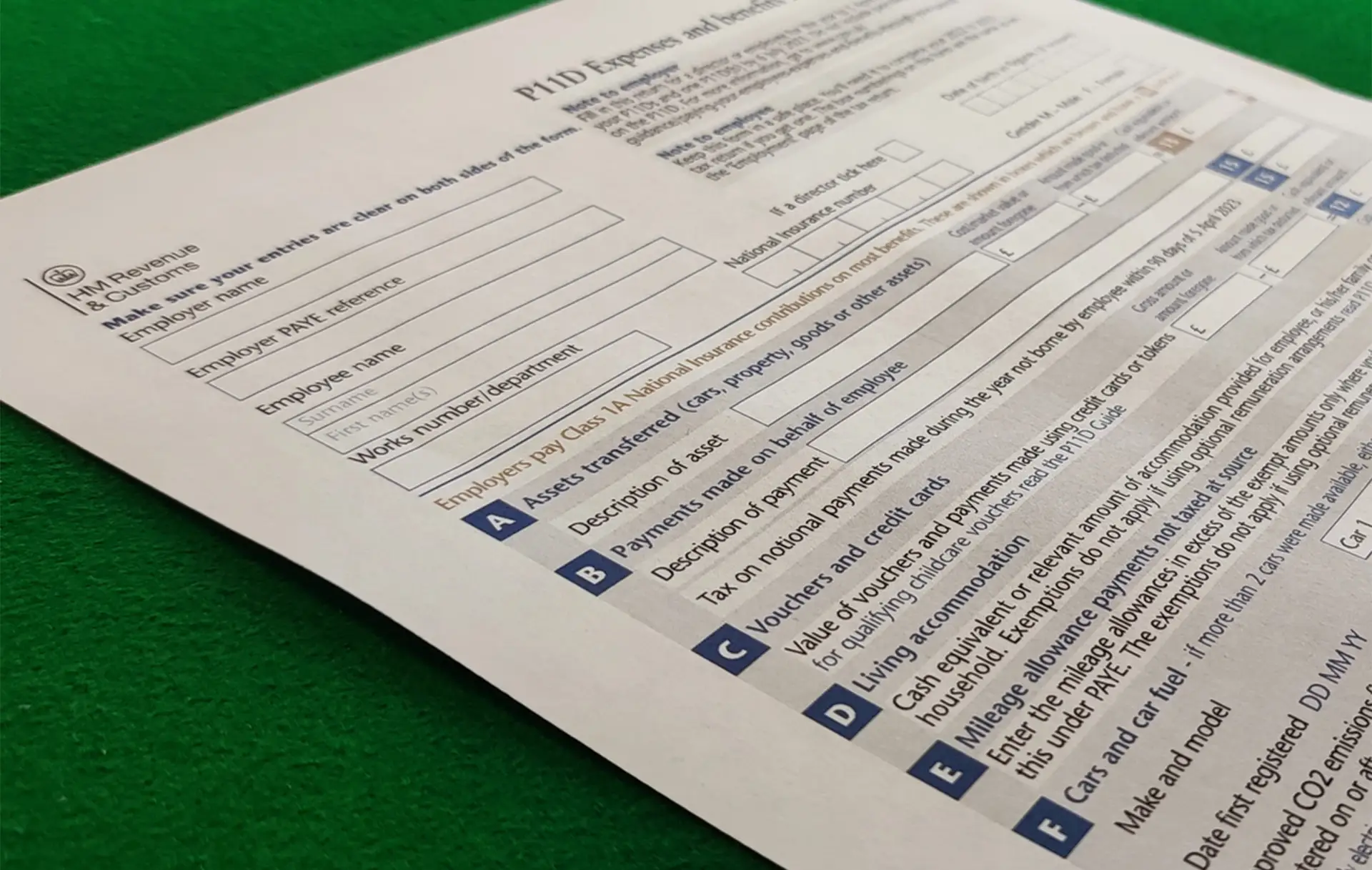

Traditionally, taxable benefits or taxable work-related expenses received by an employee in a tax year are reported on form P11D. Popular benefits include company cars and private healthcare insurance.

Under the current regime, employers submit P11D forms to HMRC, together with the P11D(b) summary form detailing the amount of Class 1A National Insurance (payable by the employer on the benefits). Employees then pay income tax on the benefits received, usually through an adjustment to their PAYE code or sometimes via their tax return.

Payrolling benefits has been commonplace for a number of years for standard benefits such as healthcare. Simply put, payrolling is where an employer puts the taxable value of the benefit through the payroll, removing the need for the P11D form altogether.

The 16 January measures announced included a proposal that, from April 2026, it will be mandatory to payroll benefits provided to employees. This means that it will be mandatory to report benefits, and pay income tax and Class 1A NICs on the value of these benefits via payroll software. The intention is that this latest change will build upon the digitisation of tax processes we have seen in recent years included the requirement for P11D forms to be filed electronically since April 2023. According to HMRC, the proposed move will simplify the tax affairs of 3 million people and remove the need for 4 million P11D end of year returns to be submitted.

With these changes coming down the road, businesses may now wish to move to payrolling their benefits. This will allow them to familiarise themselves with how it operates. It should be noted though that payrolling cannot be used for beneficial loans and living accommodation. There is also still a current requirement to submit P11D(b) forms.

The new measures are still being finalised and it will be interesting to see what the final proposals look like. For example, to allow for the payrolling of beneficial loans HMRC will need to allow for balances to be estimated, and they will need to fix the official rate of interest, at the beginning of each tax year.

HMRC plans to engage with stakeholders and industry experts to produce guidance on the changes. At this stage though it does look like it is finally the time to wave goodbye to the P11D forever.

This represents a significant change in how benefits are reported and is likely to cause many headaches as the clock starts to tick down. Now is the time to get ahead of the game and talk to our payroll department about how we can assist you – contact Sadie Jowitt on payroll@kilsbywilliams.com.