The old regime would place the taxpayer into a surcharge period when they either failed to submit their VAT return on time or their VAT payment was late. During the surcharge period, penalty surcharges could be issued for further defaults.

The new regime for late submissions is a points-based system with penalties only issued when a taxpayer reaches a penalty point threshold.

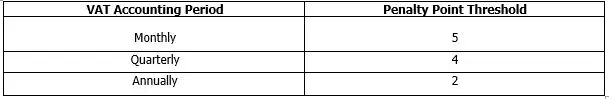

Penalty points are received every time a taxpayer fails to submit their VAT return on time, and the threshold depends whether the taxpayer submits VAT returns monthly, quarterly or annually.

The table below summarises the penalty point thresholds:

A £200 penalty is issued when the taxpayer reaches their points threshold, and a further £200 penalty is issued for every late submission whilst at the threshold.

Providing the taxpayer is not at their points threshold, penalty points will expire after two years. If they are at their penalties threshold they will also need to complete a period of compliance.

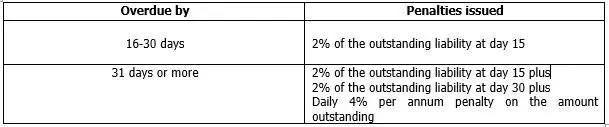

As well as late submission penalties, there are late payment penalties if a payment is more than 15 days late and the taxpayer has not entered into a time to pay arrangement by this time. The penalty is a percentage of what is outstanding and increases with time:

Additionally, late payment interest accrues from the payment due date until the liability is settled in full at the Bank of England base rate plus 2.5%.

The impact of this change is that the VAT penalty system now offers a margin of non-compliance for the taxpayer, instead of immediately placing them into a surcharge period following one instance of being in default. This is beneficial for businesses that wholly submit and pay their VAT returns and liabilities on time, but may occasionally be late.

In HMRC’s view, the introduction of late payment penalties and interest will provide more of an incentive for taxpayers to settle their VAT liabilities as soon as possible.