Currently employees pay 12% NIC on earnings between £9,568 and £50,270 (£9,880 from April 2022) and 2% on income over that level. Employers suffer 13.8% on income over £9,100. This will rise to 13.25% and 15.05% from next month respectively.

What can be done to mitigate exposure for employees and employers to this increase?

Dividend planning strategies may be utilised once a salary has been taken to cover the personal allowance and ensure entitlement to certain state benefits. Dividends are liable to tax at a lower rate and not subject to NIC. To maximise cash flow and reduce tax liability still further, ‘leapfrogging’ dividends (paying them every other year) can have a further attraction as the individual will not have to make payments on account. Note the exception of the £2,000 dividend allowance, which should generally be utilised annually.

For non-shareholders a salary sacrifice arrangement may be beneficial. This is a formal arrangement under which an employee accepts that they will receive a lower taxable salary than previously and instead receive an agreed benefit or package of benefits for a minimum period (usually one year). There is a further advantage to employees who have taken student loans as their repayments are calculated on their gross pay after the operation of the salary sacrifice.

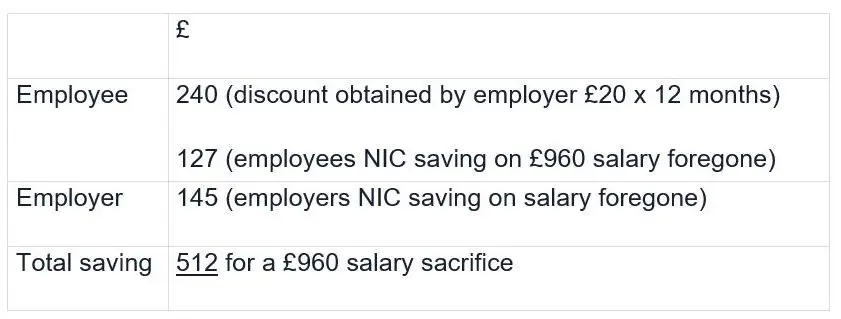

In our December newsletter, we explored the tax saving for both the employer and employee of leasing an electric car. Another example could be gym or golf club membership offered under salary sacrifice. If the membership generally cost the employee £100 paid from their net salary, an employer could arrange a discount with the club for bulk membership (say £80 per month) and offer it to their employees via salary sacrifice (£960 per annum). In this example, the savings on a sacrifice of £960 per annum would be as follows:

The NIC increase should not be ignored and plans should be implemented now to ensure the effects are mitigated as much as possible.This path may not be right for everyone. Giving up a taxable salary in favour of a benefit may affect other work-related benefits that depend on the rate of pay and state benefits such as tax credits and jobseekers allowance may also be affected. However, this is not the case for the majority of employees and even something simple like salary sacrificing pension contributions may be helpful.

Due to the complexity of the rules, professional advice should be sought at the outset. For advice on personal tax planning please contact your Kilsby Williams team member or Diane Nettleton on 01633 653167 or by email – diane.nettleton@kilsbywilliams.com